Nevertheless, you could experience substantial tax Advantages afterwards When your earnings climbs and pushes you into a greater tax bracket. If the predicted foreseeable future tax legal responsibility is probably going to be greater than it is currently, a tax-exempt account wouldn't insert on your tax burden.

Searching for far more Strategies and insights? We'll produce them proper for your inbox. Manage subscriptions

We don't supply economic advice, advisory or brokerage services, nor can we endorse or recommend men and women or to buy or promote certain stocks or securities. Effectiveness information and facts might have modified since the time of publication. Earlier general performance is not indicative of future benefits.

Get Forbes Advisor’s specialist insights on investing in a number of monetary devices, from shares and bonds to cryptocurrencies plus more.

Enthusiastic about turning out to be a real estate investor? A course like Skillshare’s “Excel in Housing Investing” can provde the information and skills you may need, like How to define and benefit Houses, to just take another move.

For those who are interested in Benefiting from these deductions, start out by knowing different tax-deferred account options. Many of the most popular tax-deferred account options consist of:

Exactly where we advertise an affiliate husband or wife that provides investment products and solutions, our advertising is limited to that find here of their detailed shares & shares investment platform. We don't advertise or really encourage every other merchandise such as agreement for difference, spread betting or forex. Investments in the forex other than sterling are subjected to forex exchange hazard.

Most of us are familiar with borrowing, whether it’s a couple of lbs . from a colleague, or through a formal loan such as a property finance loan that will help purchase a residence.

With 2025 off to your rocky get started, lots of buyers can be searching for options to adjust their portfolios.

Vital authorized information regarding the e-mail you're going to be sending. Through the use of this assistance, you conform to input your real e mail deal with and only send out it to individuals you recognize.

Remember that investing entails chance. The worth of the investment will fluctuate with helpful resources time, and you may achieve or reduce revenue.

Assuming that The cash goes directly to an suitable Corporation from a IRA, you could steer clear of being forced to claim the distribution as taxable great post to read cash flow, though you'll nonetheless should report it in your tax return.

This usually occurs when rates tumble. Inflation threat - With reasonably reduced yields, money produced by Treasuries can be reduce than the speed of inflation. This doesn't utilize to Guidelines, which can be inflation secured. Credit history or default possibility - Traders must be knowledgeable that all bonds have the potential risk of default. Buyers should really check present-day occasions, together with the ratio of countrywide financial debt to gross domestic product or service, Treasury yields, credit history ratings, and the weaknesses in the greenback for symptoms that default risk may very well be mounting.

You will find many sorts of bonds. Historically, particular bonds have already been considered much less dangerous than investing in shares or shares-dependent money, since they give regular money payments and entitle their house owners to acquire payment prior to shareholders if a company folds.

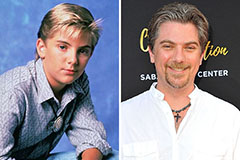

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Tahj Mowry Then & Now!

Tahj Mowry Then & Now! Ashley Johnson Then & Now!

Ashley Johnson Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now!